Hence, there is a 100% combination of all the subsidiary revenue to the parent.

#Imindq financial consolidation full#

Besides, all the subsidiary revenues and expenses are transferred to the income statement of the parent. Thus the account of a subsidiary is in full control of the parent company.īoth the parent and subsidiary income statement is reported as one. In the full consolidation method, the parent balance sheet records the subsidiary assets, liabilities, and equity. With regards to the parental control over the subsidiary, financial accounting consolidation follows three methods: Intragroup transactions and balances should be eliminated completely.

Such a case occurs where the companies are sharing employees.Ħ. But, in case the mother company controls below 50%, its significance level matters. The parent company must be in control of more than 50% shareholding. Here, every transaction must have at least 2 accounts (same amount), with one being debited & the other being credited. It is done according to the accounting rules Accounting Rules Accounting rules are guidelines to follow for registering daily transactions in the entity book through the double-entry system. Subsidiary reports are compiled as if the same company does not exist. All like transactions and similar events should be accounted together using the same set of accounting policies.Ĥ. read more (stock not owned by the mother company) is to be disclosed and accounted for separately.ģ. The minority shareholders do not have control over the company through their voting rights, thereby having a meagre role in the corporate decision-making. Any minority interest Minority Interest Minority interest is the investors' stakeholding that is less than 50% of the existing shares or the voting rights in the company.

The time difference should not exceed six months.Ģ. If a subsidiary cannot submit them on the said date, the company should make adjustments for the effective date.

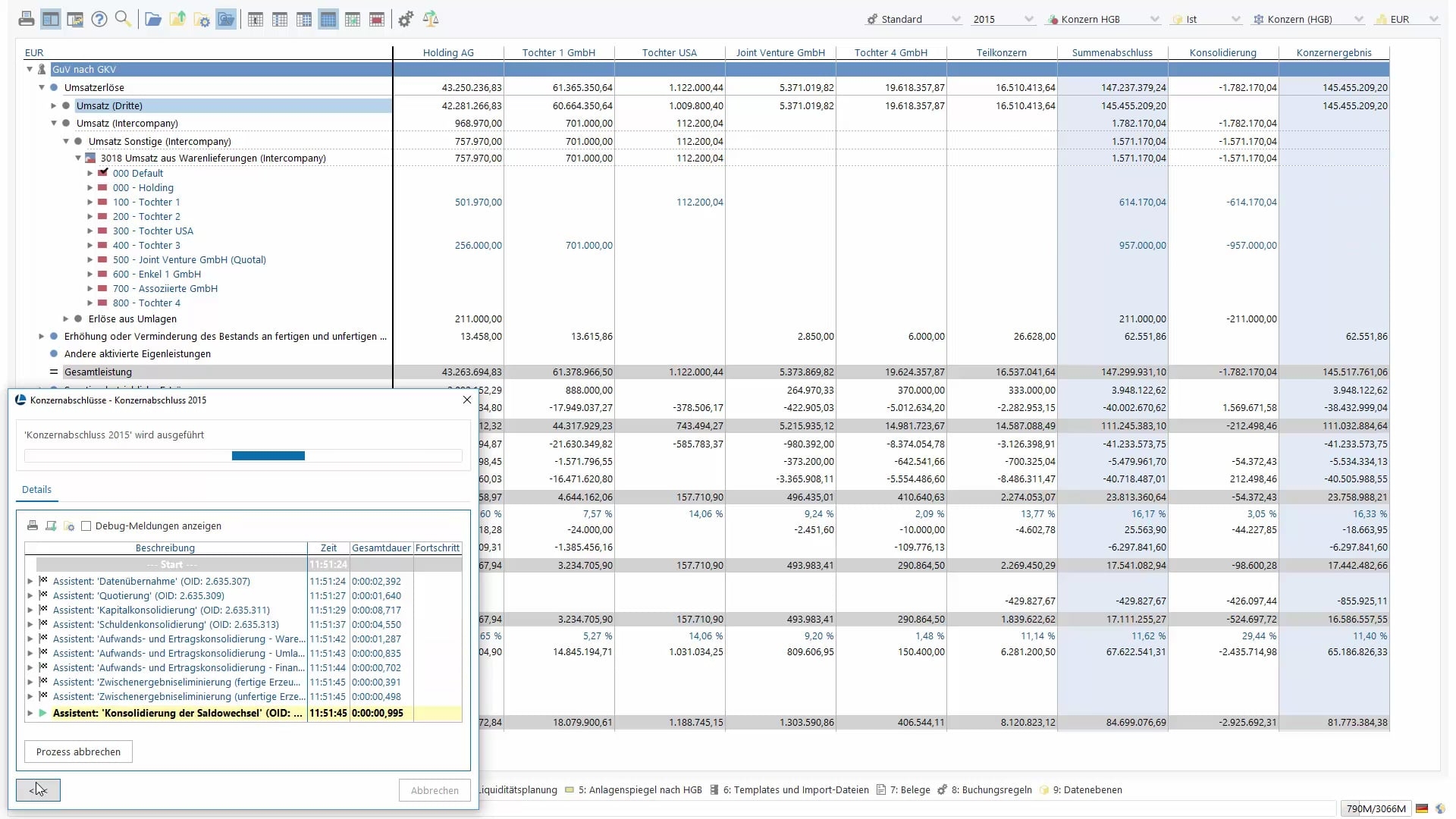

Subsidiaries are either set up or acquired by the controlling company. The control is exerted through ownership of more than 50% of the voting stock of the subsidiary. read more and subsidiary companies Subsidiary Companies A subsidiary company is controlled by another company, better known as a parent or holding company. This company also generally controls the management of that company, as well as directs the subsidiary's directions and policies. Financial statements for parent company Parent Company A holding company is a company that owns the majority voting shares of another company (subsidiary company). Some of the regulations guiding the consolidation process in accounting are:ġ. Source: Consolidation Accounting ()Ĭonsolidation accounting needs to follow a certain set of rules.

#Imindq financial consolidation how to#

You are free to use this image on your website, templates, etc, Please provide us with an attribution link How to Provide Attribution? Article Link to be Hyperlinked

0 kommentar(er)

0 kommentar(er)